vt dept of taxes current use

This site provides valuable membership information and resources for consumers who are home owners buyers and sellers. Municipal officials must contact the Vermont Department of Taxes at 802 828-5860 for log in credentials.

0 Birch Hill Rd Brandon Vt 05733 Mls 4643161 Zillow Zillow Vacant Land Brandon Vt

Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction.

. To document additional taxes collected as a result of excess wear and tear andor excess mileage at the end of a motor vehicle lease contract. The program is also referred to as Land Use UVA or Current Use is a property tax incentive for eligible land whose Current Use is for forest products. Municipalities that own land in other towns can enroll parcels in Current Use.

Land use change tax becomes due when development occurs on the land. Municipal officials must contact the Vermont Department of Taxes at 802 828-5860 for log in credentials. Taxes for Individuals File and pay taxes online and find required forms.

802 828-2301 Toll Free. To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Use Value Appraisal or Current Use as it is commonly known is a property tax incentive available to owners of agricultural and forestry land in Vermont.

Chapter 124 allows eligible forest or agricultural to be taxed at its use value rather than its residential or commercial development value. Use Value Appraisal or Current Use as it is commonly known is a property tax incentive available to owners of agricultural and forestry land in Vermont. The e-mail address is not made public and will only be used if you wish to receive a new password or wish to receive certain news or notifications by e-mail.

Introduction to the Use Value Appraisal UVACurrent Use Program. Freedom and Unity Live Common Services. Vt dept of taxes current use Thursday March 3 2022 Edit.

In order to manage eCuse online applications for landowners you must first register as a consultant with eCuse. A valid e-mail address. When property is initially enrolled in the Current Use Program a lien is recorded to secure payment of land use change tax.

Current Use Taxation In brief. All e-mails from the system will be sent to this address. 2021 Current Use Appraisal Program Participant Tax Savings.

ECuse Login Current Use Program of the Vermont Department of Taxes. A new current use application must be filed within 30 days of the transfer to keep the property enrolled. Eligible landowners can enroll in the program to have their land appraised at its Current Use farming or forestry value rather than fair market value.

Click Here - For Public Records Database. Vermont Department of Taxes Current Use Division 133 State Street Montpelier VT 05633-1401 Phone. Tue 02152022 - 1200.

The Register here button is for Landowners and Consultants only. The Department of Taxes Division of Property Valuation and Review PVR is the lead. Find out if your property is eligible for this tax reduction.

ECuse will assign you a 6-digit account number. You may now close this window. Lease Excess Wear Tear Excess Mileage Tax.

Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. ECuse Login Current Use Program of the Vermont Department of Taxes. Once registered you will be able to start applications for landowners and manage applications that landowners have already started.

PUBLIC INFORMATION REQUESTS TO. Montpelier Vermont 05609 Main Phone. The Current Use Program also known as the Use Value Appraisal Program allows the assessed value for a property to be reduced by a proportion of land andor buildings enrolled in the program.

Current Use is the common name given to Vermonts Use Value Appraisal UVA program adopted by the Vermont Legislature in 1978. You have been successfully logged out. Ashlynn Doyon at treasurersofficevermontgov.

If the landowner has. Usually these lands are enrolled to protect water sources or recreation facilities. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes.

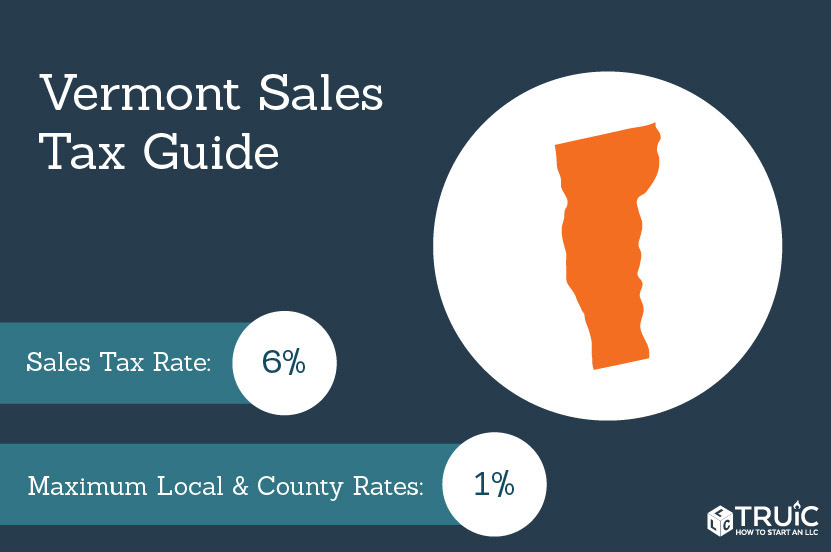

The Southern Vermont Board of Realtors SVBR is a membership association serving Realtors in the southern region of the Green Mountain state. Current Use Taxation Vermont Natural Resources Council 6 Mcallister Rd Richford Vt 05476 Mls 4733803 Zillow Old House Dreams Brick Hearth Old Houses Vermont Sales Tax Small Business Guide Truic. This is required for any transfer of title no matter the reason.

The Register here button is for Landowners and Consultants only. Plans and maps for Conservation UVA lands are reviewed by the Division of Forests but eligible organizations are vetted by the Tax Department prior to enrollment. Welcome to the Southern Vermont Board of Realtors.

Use Value Appraisal Program UVA also known as Current Use 32 VSA. The Vermont Department of Taxes specifically the Division of Property Valuation and.

Publications Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

10 Answers About Vermont S Current Use Program Vermont Woodlands Association

Guide To Current Use Vermont Woodlands Association

Vermont Sales Tax Small Business Guide Truic

Compliance Corner Department Of Taxes

Publications Department Of Taxes

Guide To Current Use Vermont Woodlands Association

Vt Dept Of Taxes Vtdepttaxes Twitter

With Scott S Signature Current Use Program Will Get A New Reserved Forestland Category Vtdigger

Vt Dept Of Taxes Vtdepttaxes Twitter

Guide To Current Use Vermont Woodlands Association

Publications Department Of Taxes